Back to the First Edition of the Future.s of Money in Paris

On June 16 and 17 2022, the blockchain@X chair at Ecole Polytechnique organized a unique event in Paris: The Future.s of Money. Many experts and actors from the economic, financial, digital and research worlds gathered around conferences dealing with the future and the digitalisation of money, now accessible to all.

An event that welcomed influential players

Supported by Capgemini, Nomadic Labs and Caisse des Dépôts, the Blockchain@X chair at Ecole Polytechnique organized an event on June 16 and 17 2022 about the future of money. The Future.s of Monnaie received 150 invited visitors over the two days it was held, 30 speakers and 14 hours of conferences and round tables. What made this event unique was its ability to bring an academic, industrial and institutional perspective to the often discussed topic of the future of money. This harmonious mix of theoretical conversations and practical implications, all taking place in a single place that brought together the most influential actors in the world of research, economics, finance and digital. The main theme of these two days of exchanges was the digitalisation of money.

The money: significant challenges for the future

Crypto-currencies have developed outside the regulatory system and escape the control and use by Central Banks. The challenge for this new ecosystem is to be able to adapt sufficiently to respect the rules and standards imposed on traditional sectors without losing the capacity for innovation. Indeed, the balance is subtle between the regulation that is necessary and the innovation that must not be destroyed. This is why many experts have taken up the subject to discuss the future of money in general, and its digitalisation in particular. The Future.s of Money aimed to present the different perspectives available to the research, finance and digital actors, learning from each other through discussions around the management and challenges of this economic transformation. One thing is certain: money and the way it is used are changing and it is likely that in the future, the payment system will allow us to make payments more easily, from any currency and at almost no cost.

The conferences are broadcast on the YouTube account of Blockchain@X

All the conferences held during The Future.s of Monnaie are accessible on the YouTube account of Blockchain@X (Ecole polytechnique). You will find all of these exchanges about the future of money in order to understand the issues (videos and presentations), to know the points of view of international experts on the subject, and to anticipate the changes that will take place in the years to come.

Please find below the links for all speakers presentations:

- Best before? Expiring CBDC and Loss Recovery – Maarten Van Oordt (VU Amsterdan)

- CBDC & Banking: Macroeconomic Benefits of a Cash-like Design – Jonathan Chiu (Bank of Canada)

- So you want a CBDC: how will you do it? – Andreas Park (University of Toronto)

- Central Bank Digital Currency: Infrastructure for Digital Cash – Jack FLETCHER (R3)

- CBDC Infrastructures – Claudine Hurman (Banque de France)

- Optimal Data Security with Redundancies – Linda Schilling (Olin Business School)

- How CBDC Design Choices Impact Monetary Policy Pass-Through & Marlet Composition- Rod Garratt (USCB)

- CBDC & Quantitative Easing – Martina_Fraschini (University of Lausanne)

- CBDC when Price Bank Stability Collide – Harald Uhlig (University of Chicago)

- CBDC and Monetary Policy – David Andolfatto (St Louis Fed)

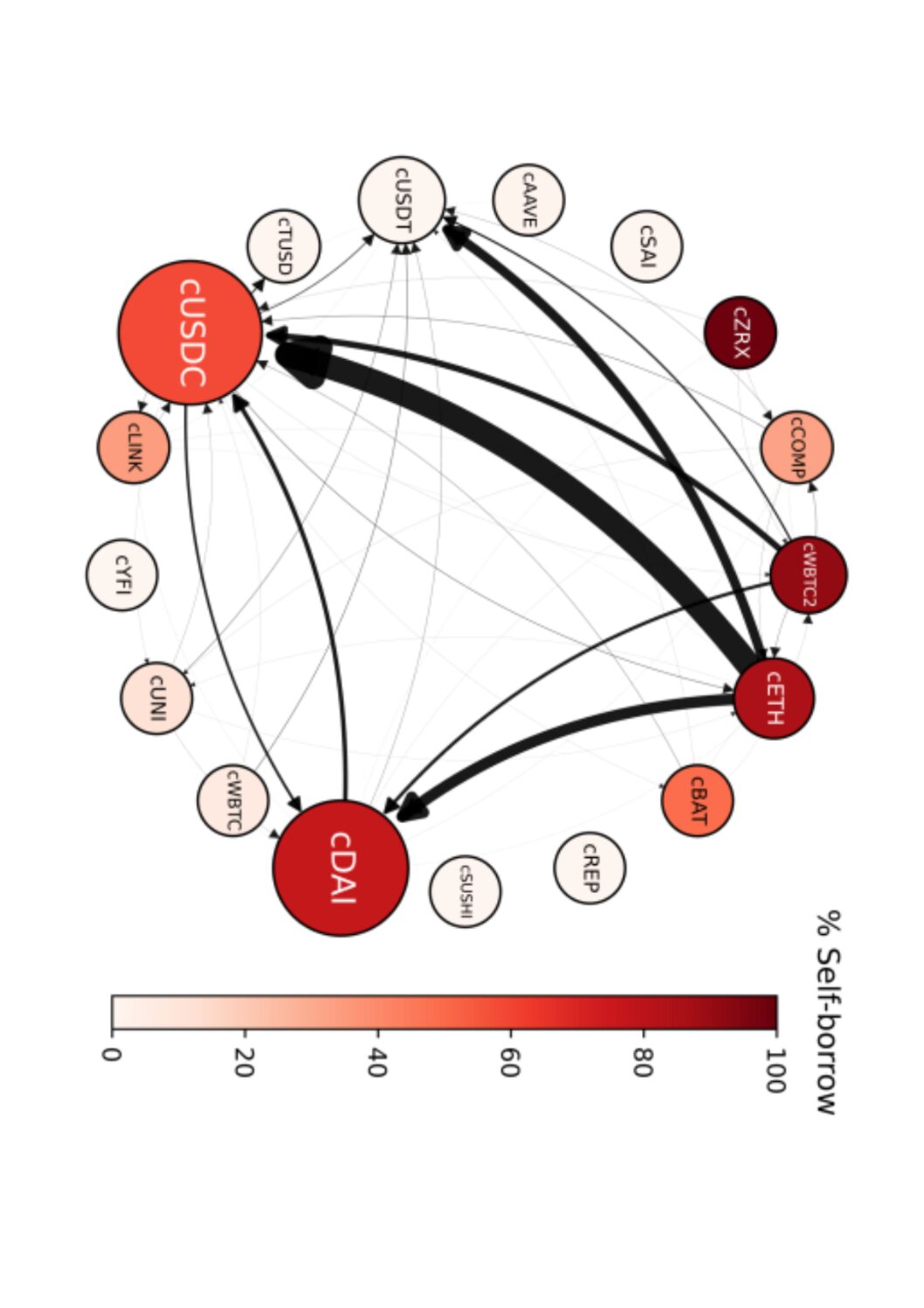

- Money Creation in decentralized Finance – Simon Mayer (University of Chicago)

- Ligthning Network Economics: Channels – Gur Huberman (Columbia University)

- The Coming Battle of Digital Currencies – Lin William Cong (Cornell University)

- CBDCs Motives, Economic Implications and Research Frontier – Jon Frost (BIS)

- From Adam Smith to Nakamoto: a survey of (crypto)currency theories – Bruno Biais (HEC)

- Policies For Digital Currency Innovation & Payment-System Disruption – Darrel Duffie (Stanford University)

- Tezos as a payment infrastructure – Cedric Roche (Nomadic Labs)

- Scaling CBDCs with Validity Rollups – Henri Lieutaud (Starkware)

- Public Blockchain as Payment Insfrastrucuture on Algorand – Pietro Grassano (Algorand)